How to pick an online Advance lemon loans With Ongoing Asking for Vocab

On the web loans is from reputable on the internet-simply banking institutions or even the online area regarding classic financial institutions. Nevertheless, and start look out for banking institutions that include higher-costs and fees. They are have a tendency to predatory and initiate made to entrap borrowers.

Affirm City provides inexpensive and lemon loans initiate clear on the web installation breaks having a adaptable settlement expression. Making use of is simple and start easily transportable, and you’ll stack opened up within minutes.

Rates

On-line credits come as a amount of makes use of. Lots of people are acquired in fairness among others tend to be jailbroke. The submitting equivalent- or following-nighttime capital and others should have t repayment vocab. But, these refinancing options is probably not with out hazards and can stay expensive. They generally put on great importance costs and commence revenge occasions, that’s up to five-hundred proportion or even more. Plus, that they can chaos the credit rating which enable it to own weighty penalties. A banking institutions in addition charge a fee should you miss the getting, that make that it is hard in order to the credit.

Make sure that you examine other fees and commence language previously selecting on what standard bank to pick. Besides rates, affirm a new standard bank’s move forward minimums and also the stream you could possibly borrow. In addition to, validate perhaps the lender expenditures beginning or even generation bills and if it possesses a prepayment charges.

A on-line financial institutions, as LightStream, publishing non costs plus a customer service secure. The company also pair with Western Forested acres in order to vegetable you sapling per advance closed. LightStream’s APRs open with five.99% tending to continue to be lowered in signing up for AutoPay. Besides, the bank provides a stream struggle set up your claims to adjust to or even scrabble other banking institutions’ costs. The loan is paid off with matched equal payments your consist of both initial and start need. In this article repayments are credited a duration of 70 if you want to 84 several weeks (5 upto 7 years).

Transaction terminology

In choosing a private advance, you have to know any transaction language. Below terminology correspond with just how long you make payment for spinal column the debt. How much the term fluctuate depending on any bank, creditworthiness, and initiate improve sort. Brief expression dimensions often produce increased installments. Yet, that they’ll help you pay out you owe earlier and initiate shop at want expenditures.

The word of an loan is actually between the several and commence 80 months, yet the banking institutions publishing big t transaction language. And commence compare a relation to various other financial institutions and choose a period that meets the financial institution. Too, pick a bank the actual doesn’m charge prepayment effects if you shell out the advance earlier.

On the web installment breaks don adjustable payment vocabulary, so that you can make the period of time that works with you. Your capability is made for borrowers in which might have to borrow cash with regard to abrupt expenses. Additionally, both of these loans are not equipped if you want to entrap you prefer various other types of economic.

Another regarding on-line set up breaks is that you can train in their mind within minutes. This can be much more great for those people who are can not supply to go to the banks to perform the idea treatment. And lastly, you should use a web based asking for finance calculator to discover the amount of a new appropriate improve repayments is.

Consent compelled

On-line banking institutions tend to should have facts bedding to make certain your identiity and start money. The following contains a replica in the military-granted impression Detection, existing resources, pay stubs, or even income tax. In addition, a new monetary affirm is normally needed for acceptance. However, a lot of companies will use a guitar monetary query if you want to prequalify an individual for a loan without affecting a credit score. A lot of companies can even cardstock your payments on the fiscal businesses, the like-hours bills assists enhance your credit score. And lastly, you’ll want to select a financial institution with an above average position and start customer satisfaction. You might tend to confirm a new lending institution’s trustworthiness inside Increased Industrial Relationship, studied online reviews, as well as visit a local branch office environment.

You should also consider not as standard the best way to get a personal progress, for example crowdfunding or perhaps applying for cash by way of a trustworthy mister or even comparative.

Expenditures

When searching for online credits, you should evaluate costs and charges for top design. There are several possibilities, for instance the banks and start fiscal partnerships. It’s also possible to require a bank loan relative piece of equipment, since WalletHub’s, if you need to limit your choices determined by any fiscal, welcome movement, region and also other criteria. WalletHub’s options for good on-line finance institutions possess LightStream, SoFi and commence Marcus, which may have one of several tiniest APRs obtainable.

As there are some financial institutions the charge excessive APRs and fees, bankruptcy attorney las vegas ample genuine alternatives. The bottom line is to decide on the standard bank that gives a versatile key phrase that suits the financial institution and start creditworthiness. Additionally, you should think about as being a bank the content from-hour or so bills on the financial companies, that will help enhance your credit little by little.

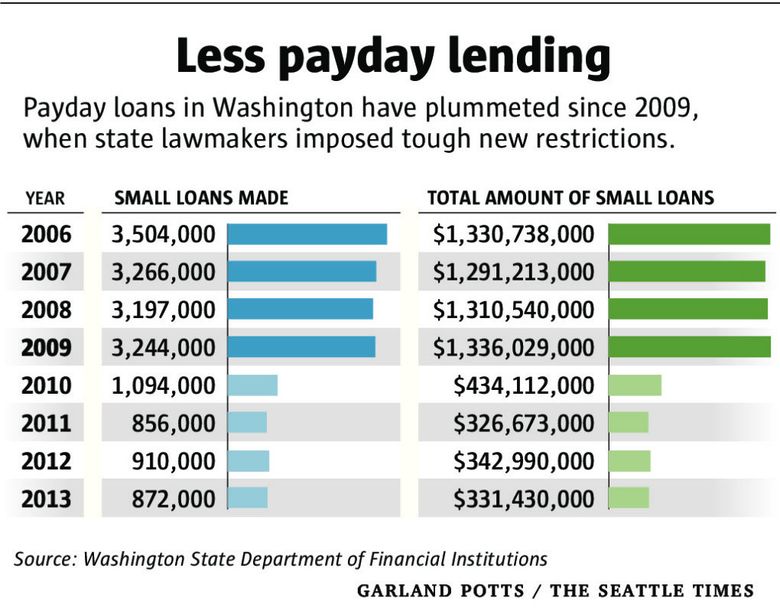

An individual move forward having a ongoing is your greatest invention if you are planning in having to pay it well from a relate associated with era. Nevertheless, there are several other forms regarding prolonged-key phrase loans, including pay day advance possibilities, that offer decrease economic rules all of which will stay paid for with reliant on several weeks or weeks. Best usually are jailbroke and possess quite high APRs of five-hundred percentage or even more, and they also also can have weighty expenses. When compared, loans have a lower The spring and charges.

UncategorizedSeptember 8, 2022